Is she dancing? Is she crying? Is she performing an ancient ceremonial dance to bring rain after a long drought? Is she drying her finger-nails after painting them with 3 layers of 'glitter-gloss'?

Is she dancing? Is she crying? Is she performing an ancient ceremonial dance to bring rain after a long drought? Is she drying her finger-nails after painting them with 3 layers of 'glitter-gloss'?Is she slapping her face because it's good for her

circulation? Is she trying to rip holes in the arm-pits of her sweat-shirt

so her mom will buy her a new one? Is she smacking her face every time she

hears of a new foreclosure on one of those sub-prime loans? Is she trying

to wave down a helicopter to give her a lift to the nearest shopping mall

because her mom and dad can't afford the gasoline?

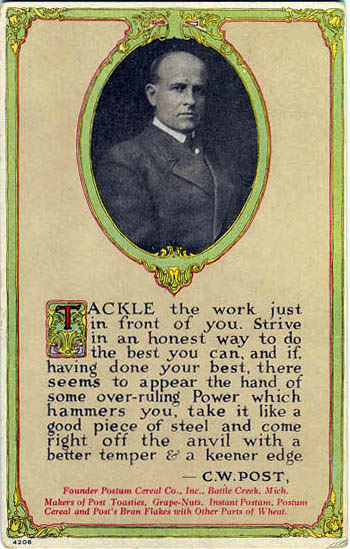

If you're as old as me, you only

see that this 'newest recession' is just 'history repeating itself'...or

'smacking itself side the head'............

Anyway - read on - repetition (even of an

adorable young girl's hair flying in the wind) gets as tiring as the stories

I've been reading daily, about this nation's economy.....-------------------------------------------------------------------------------------

Since I've been helping young people (locally), I think some of the ideas that not only I might have, but what they've come up with, will be put here - we can treat this as a 'running entry'.

Now: How resourceful is this one? One of our neighbors had

nothing more than a chest freezer that he was using for keeping foods 'on hand'

- buying on sale, etc. (we all know the routine).He had a used boat; went down to the marina to put a 'for sale' sign on it -

it was hot; he was miserable, and he sat for hours. While he was watching

the boaters launch their boats, he was struck with an idea.He saw people going inside to the near-by casino; coming back with crushed ice - filling their ice-chests. He went inside - saw the machine, and wondered....

Two days later, he took old plastic bags; filled them with water -sat them

inside old shoe boxes that were in his storage locker, and they acted as 'molds'

for ice. He went back to the marina and casino. He went inside to

see why there were two or three men yelling at each other at the open door near

the ice-maker.Well, all the boaters had taken so much ice, the casino/hotel, had made it operable only to hotel guests; the room key had to be presented, and of course that meant you had to have paid for a night's stay!

Aha - now was the time to 'launch' not his boat, but his idea.

He tugged his small boat back home; he filled the boat with those blocks of

ice - he took them back, and sold them for 50 cents a block! He sold out

so fast, he couldn't believe it.Where he RENTED, the water was paid for; back he went - cold water into the

bags...into the shoe-box 'molds', and over-night, solid blocks of marketable

'ice'....On the week-ends, he gets $1.00 for each block; the tourists are in a hurry - they 'buy', and the hotel is happy because they don't have anyone stealing from the ice machines!

He now makes between $30 and $60 a day; he does this in between his

swing-shift; it's tax-free, and he can average between $900 and $1800/month on

'frozen water'.....As my grandson would say: '...Cool...'

-------------------------------------------------------------------------------------

This is the budget I did for a young family – the before & after results!

(note: they asked that their income not be used, so we will show only how we reduced expenses)

Fixed expenses

Rental - $800/month

Water – included with rent

Trash – included with rent

Parking – included with rent

Electricity - $120/month

Fixed phone - $25/month

Cellular phone #1 - $59/month with ‘family added free’

Added phones: 3

Average costs for overage on excessive use: $50

Text messaging services @ 20 cents each: Average $15

Mobile services/photos/ring-tones, ‘extras’: $20

Cable t.v. – ‘bells & whistles’: $140

Rented movies: $40

I-net services: $30

Dial-up costs for minutes billed over plan: $40

Car insurance – 2 cars: $200

Car payments – 2 cars: $540

Plates, maintenance – repairs not put on credit card: $30

Car repairs & maintenance put on credit card: $80 (average)

Clothing: All currently on credit card due to lack of funds – minimum payment on cards are $25 (x) 4 cards = $100 (with interest, the balance isn’t dropping)

Meals out: Average – cash out-lay: $340

Meals out: - Average – added to credit cards: $120

Groceries: $700

Gasoline: 50% added to credit cards - $150; cash - $100

Household items – needed (so they say, so I go with it): $100 – all on credit card

School costs; other costs for 2 children under 18 years of age: $150

Stamps; shipping – computer supplies & miscellaneous: $125 – 50% put on credit card

Savings: nothing – to maximum of $100

Entertainment out (not including food): $160

Children’s allowances: $120

Total (not including the fact they’re adding some of their expenses to their credit cards): $3,892 (rounded off)

This is an annual total of: $46,704 – a number that is NET (after their income taxes are taken out; FICA, and they’ve recently been told they have to now pay their medical insurance costs by their employers)Add that cost: $540 for a minimum plan per month (x) 12 = $6,480

Bottom

line is: $53,184 – net income after taxes and medical expenses must be

achieved to maintain their ‘life-style’.

Now the sad truth: They don’t make enough money to meet these obligations.What we eliminated is illustrated in RED.

What was substantially REDUCED, is illustrated in BLUE.

The total in elimination per month: $405

The total in reduction per month: $710

Combined results: $1,115 = Former monthly with medical insurance

costs: $4,432 now reduced to: $3,317/month. Essentially

a reduction of about 25% - now they will meet their obligations.As you examine this, you can see there is more room to eliminate and/or reduce. At this point, they felt they wanted to keep that expensive monthly 'cable' bill; yet, they can cut this down by about $80/month.

They can eliminate all meals eaten out!

They can have their children go without an allowance until things 'smooth out'...

Because they didn't want an 'austere' budget or plan, since we met their

needs so they could BALANCE their income with their expenses, they are quite

happy for the moment.--------------------------------------------------------------

Now - most importantly:

We must notice that their net income is over $50,000.

We must remember this means a gross of about $80,000.

We have to realize this is a 2-family income situation; neither have the education and opportunity to make $80,000 as a single-income household.

We have to remember their children are old enough not to require a baby-sitter.

We have to understand that millions aren't even close to this type of income or 'situation'.

There might be more to 'realize' and analyze as we must all come to have understanding for those individuals who offer up food-stamps while we could be 'cursing them' - feeling as if 'our taxes' are 'supporting them'....okay, they are!

We will have to resist all urges to be critical about others until we sit down with a friend or neighbor, and openly discuss their 'plight'....

I'm able to handle my needs - we are on fixed income; we do know how to 'manage', and because of that, my 'retired' situation shows me I must spend more time 'helping others' handle the difficult times ahead...

--------------------------------------------------------------

A reader sent this link; said he'd had success making extra money this way.

While I haven't reviewed it in depth (just about a 10-minute glance), you might want to see if this could work for you.....

http://www.friendsandmoney.co.uk/paid-reviews.html

--------------------------------------------------------------

We installed 'Magic Jack' - works with our computer; $19.95 a year, and a one-time cost of $49 for the system.

Our base charge on 'fixed phone', was costing us $240/year - and we had only LOCAL service (no long-distance).

Now we have unlimited dialing for long-distance; no long distance charges, and we don't have to worry about having our cellular phones 'charged up', since we do maintain those for travel.

Our cellular phone has been a 'God-send'; after being stranded and needing road service - being in car accidents that required also calling for help (and reporting the accidents), we now make sure one of the 2 phones stays in the car at all times; this way, we never are without a phone in the car.

Also: Remember phone cards have their place - low users love them (we're not low-users).

My mother is almost 84 years old - she won't use a cellular phone, and still struggled with 'coins' in the pay-phones (which she says she's seeing less and less of).

Still, when she needs to make a call, we now make sure that for Mom's Day, we include a pre-paid phone card that gives her 6 months of 'emergency calling' (or just calling to say hello without ruining her tiny budget).

I also had pictures of her old home-stead put onto postage stamps. No, this is not a thing you do to SAVE money - it costs a lot to have those 'custom stamps' made, but since we paid the bill, mom no longer has to pay postage on her first-class mailings, and she's just so proud and happy to use those stamps because it reminds her of her youth and happy times.

If you're going to give a gift, try avoiding the 'gift-card' routine; all the cards we get as gifts, always have a 'fee' attached - some are not easy to 'negotiate' either....

Instead: Give the phone card - it saves the recipient money; could generate a lovely 'hello' from someone you love.

Give the gift of stamps - if you can afford it. Put the grand-child on the stamp; the new home - a family photo; something that is unique...it's a usable gift; a thoughtful gift, and each time the user places it on a mailing, they will think of you.

In our household, we think 'cash only' as we shop each week. We budget our groceries and our personal allowances; the sum total is carried in our pockets - CASH.

We make an allowance for GASOLINE - it goes on a credit card so we can 'track' the date and the cost. We pay that amount off each and every month.

We do NOT use debit cards except in extreme emergencies. It's way too easy to lose track of 'what you spent' - and the balance.

One member of our family learned the 'hard way', about being charged $35 as an 'over-draft' fee - and was only over by $1.24!

One person is shopping - carrying the family debit

card; makes purchases. Another person of that same family is doing the

same....No one is telling the 'other one', that they're

'spending money'. Aha, and of course with no 'clue' as to what's going on,

the bank hits them with an over-draft fee.Learn to carry your credit cards as 'hard cash' that is more safe than 'cold cash' - then pay off the balance each month (as we do), and no interest charges. We do NOT carry one card that requires an annual fee - to us, that's nonsense.

Oh yes, and about those HOLIDAY COSTS?

Further down on this 'blog', I've listed what we

do about those 'holiday gifts' and celebrations; how we've cut out 100%, the

'commercialism', and the joy we've all had by giving to charity instead of each

other.